Physical Address

1/1-3B, Siva Nagar, 100 Feet Road, Kovai Pudur, Coimbatore, Tamilnadu - 641042, India

Physical Address

1/1-3B, Siva Nagar, 100 Feet Road, Kovai Pudur, Coimbatore, Tamilnadu - 641042, India

Apple Inc. (NASDAQ: AAPL) continues to be a cornerstone in the global tech industry and a key player in the U.S. stock market. From consistent revenue growth to headline-making earnings calls, AAPL remains on the radar of both institutional and retail investors. In this article, we explore Apple’s current stock price, review recent earnings, and highlight key takeaways from the latest Apple earnings call.

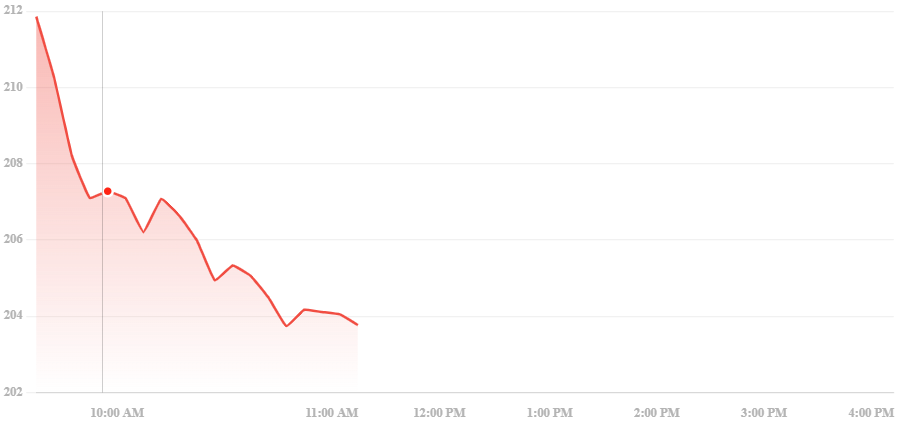

As of August 1, 2025, around 15:05 UTC, AAPL is trading at $204.32 per share, down approximately 0.02% from the previous close

| Open | 210.94 | Market Cap | 3.28T | Year Low | 169.21 |

| Day Low | 203.67 | P/E Ratio | 33.72 | Year High | 260.10 |

| Day High | 213.41 | Volume | 36.9M | EPS (TTM) | 6.42 |

The Apple stock price (AAPL) reflects the market’s confidence in one of the world’s most valuable and innovative companies. Traded on the NASDAQ, Apple’s share price is influenced by product launches, earnings reports, global demand trends, and broader tech sector movements. Investors closely watch AAPL for long-term growth and dividend stability.

Apple earnings are quarterly financial reports that reveal the company’s performance across revenue, profit, product categories, and global markets. These earnings give investors insights into how well Apple’s iPhone, Mac, iPad, and services are performing, and they often set the tone for the broader tech industry.

The Apple earnings call is a live conference held after each quarterly earnings release, where Apple’s CEO and CFO discuss the financial results, provide guidance, and answer analyst questions. It offers valuable insights into Apple’s strategy, challenges, innovations, and market outlook — making it essential listening for investors and analysts.

As of August 1, 2025, AAPL stock price hovers around $204.32 USD. Marking a [Y]% change year-to-date. While Apple has experienced fluctuations due to market-wide tech trends and macroeconomic pressures, the company has demonstrated long-term resilience.

Investors still see Apple as a reliable long-term investment, especially with its aggressive share buyback program and strong brand moat.

Apple reported its fiscal third-quarter earnings on July 31, 2025 after market close.

On the Q3 earnings call (July 31, 2025), CEO Tim Cook and CFO Kevan Parekh emphasized several important themes.

Apple’s AI strategy: significant ramp-up in AI investment, resource reallocation, and openness to acquisitions to accelerate innovation

Tariffs impact: incurred approximately $800 million in costs during the quarter; expecting $1.1 billion in tariffs next quarter if trade policies remain unchanged

Supply chain shifts: increasing production in India for iPhone and Vietnam for iPad, Mac, and Watch to mitigate tariff exposure

| Metric | Value |

| Date reported | July 31, 2025 (after market close) |

| Revenue | $94.0 billion (+10% YoY) |

| EPS (diluted) | $1.57 (+12% YoY) |

| Net Income | $23.4 billion |

| iPhone revenue | $44.58 billion (+13%) |

| Services revenue | $27.42 billion (+13%) |

| Mac revenue | ~$8.05 billion (+15%) |

| iPad revenue | ~$6.58 billion (–8%) |

Apple delivered a solid Q3 FY 2025 performance with $94 billion in revenue and $1.57 EPS, beating expectations across multiple metrics. Despite challenges from tariffs and delays in AI rollout, Apple’s iPhone, services, and Mac divisions grew strongly, demonstrating resilience and broad-based consumer demand.

If you’d like to dive deeper into the earnings transcript, exact product‑segment breakdowns, valuation multiples, or the stock chart trends, feel free to ask!

Yo, x444game! Heard some buzz about this one. Gonna check it out and see if it lives up to the hype. Wish me luck! Click here: x444game

https://www.2jili.org I am thanksful for this post!

fb777login https://www.fb777loginv.org

okebet3 https://www.okebet3u.org

mwplay88fun https://www.mwplay88fun.org

jilibet004 https://www.jilibet004.org

phtaya 63 https://www.phtaya-63.org

tayawin https://www.tayawinch.net

phwin25 https://www.phwin25g.net

98jili https://www.98jilig.com

okebet168 https://www.okebet168u.org

tg77com https://www.tg77com.org

phl789 https://www.nphl789.net

vipjili https://www.vipjiliji.com

99boncasino https://www.99boncasino.net

bk8casino https://www.bk8casinovs.com

phtaya10 https://www.phtaya10y.com

fb777 slot https://www.fb7777-slot.com

pin77 app https://www.pin77.tech

ph22login https://www.ph22login.org

2222ph https://www.be2222ph.org

taya777login https://www.wtaya777login.com

2jili https://www.2jili.org

pin77 casino https://www.pin77-ol.com

a45com https://www.a45com.org

gkbet https://www.gkbeth.org

91phcom https://www.91phcom.net

jl16login https://www.adjl16login.net

pin77 online https://www.pin77-online.com

balato88 https://www.balato88u.com

[3394]PH235 Online Casino: Official PH235 Login, Register & App Download for Top Slots in the Philippines Join PH235 Online Casino for the best slots in the Philippines! Secure your ph235 login, ph235 register, and ph235 app download today. Access your ph235 slot login now for big wins at the official ph235 online casino. visit: ph235